If you’re like most people, you can hold very few of your investments (possibly none at all) in your hands. In today’s climate, people from all walks of life struggle to achieve economic security. As Sean Bassik has found, investing in tangible, collectible assets offers a sense of stability and a very real hedge against inflation.

Many people’s minds jump to gold when they imagine tangible asset investing. Putting your money into gold bars or coins is a time-tested way to preserve purchasing power, but bullion is far from the only tangible asset available to investors.

“Jewelry, artwork, graded coins, watches, comic books, and sports memorabilia are all known for holding value,” Bassik explains. “But they’re generally underutilized as investments because investors have liquidity concerns.”

With Collectibles Investment Group, Bassik is aiming to break down the liquidity barrier and help more people than ever find a new sense of financial security with tangible assets.

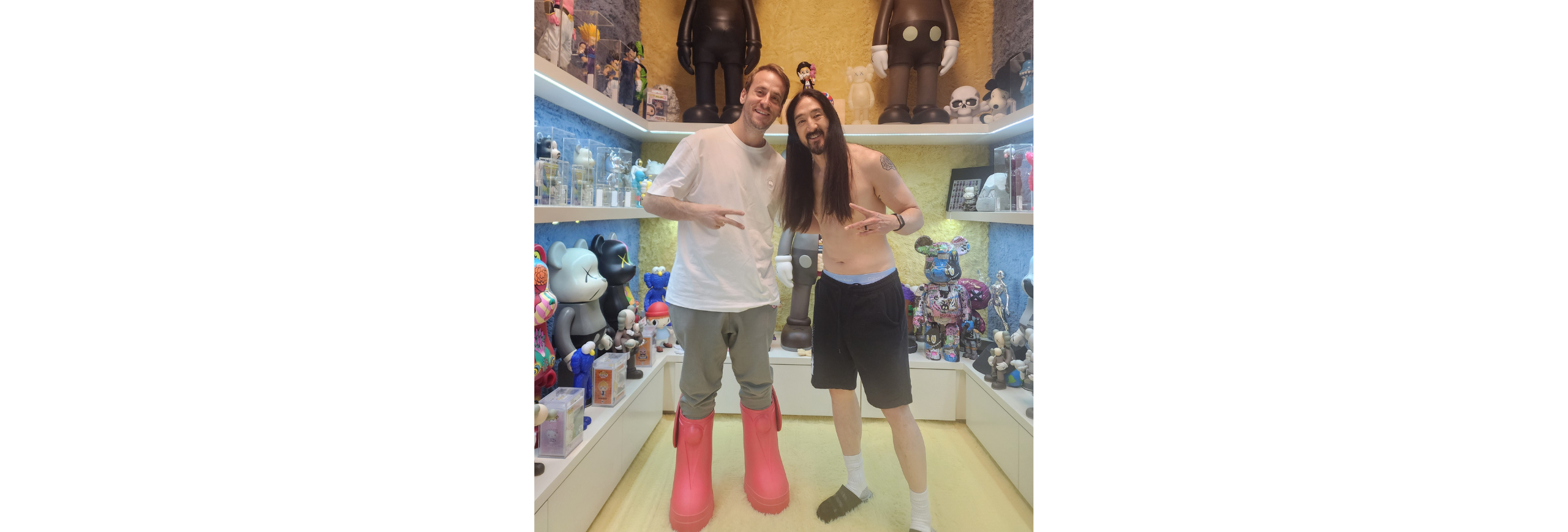

As a lifelong collector of baseball cards and other sports memorabilia, Bassik has seen firsthand how collectibles can be an effective way to preserve and even grow wealth. Before teaming up with Collectibles Investment Group (CIG), he founded Invest in Baseball, a company focused on helping clients acquire sports memorabilia. By its third year, Invest in Baseball had an annual revenue of $4 million.

“Collectibles Investment Group has access to over $8 billion in collectible assets and a large network of qualified buyers,” Bassik explains. “We can help you whether you’re buying or selling.”

Because it maintains relationships with qualified buyers, Collectibles Investment Group can help clients avoid the liquidity issues that sometimes accompany tangible asset investments. The company also assists would-be collectibles investors in navigating another common problem: authenticity concerns.

Authentic collectibles often make fantastic investments. However, as any collector knows, the market has its fair share of scammers. Someone new to tangible asset investment might be unable to spot a fake. By the time they realize they’ve been duped, it’s often too late to do anything about it.

“We have partners, advisers, and experts in every industry,” Bassik says. Before the company agrees to purchase a collection or a single item, it sends an industry expert to make an appraisal.

For anyone hoping to liquidate their tangible assets, Collectibles Investment Group makes the process as quick, simple, and transparent as possible. “We have an industry expert conduct a free review of your collection and get in contact with you within 72 hours,” says Bassik. “We don’t put clients through tough negotiations. You get our best offer up front and get paid in as little as 24 hours.”

Collectibles Investment Group similarly streamlines the acquisition process. Clients start with a confidential consultation to explore their goals, timeline, and overall budget. Once they make a deposit, Bassik and his team locate the desired item, negotiate a fair price, and arrange for transport.

Countless people have missed out on the benefits of investing in tangible assets because of logistical challenges. With the support of Sean Bassik and Collectibles Investment Group, they might just discover an effective (and fun) way to diversify their portfolios.

Written in partnership with Tom White