The California Supreme Court currently finds itself in the middle of a contentious legal battle that has gripped the attention of citizens and policymakers throughout the state. Standing at the crux of the dispute is a potentially paradigm-shifting measure slated for the November ballot. Expected to significantly reshape California’s tax methods, the proposed initiative is aimed at imposing more stringent regulations on tax increases.

This initiative has ignited fervent debates among stakeholders, ranging from Governor Gavin Newsom to Democratic legislators and influential business entities, setting the stage for a dramatic courtroom showdown with consequences that could end up being far-reaching.

Central to the debate is the hefty question of whether permitting this measure onto the ballot is a wise decision, given its potential ramifications for California’s tax system. As justices sift through legal arguments, they confront the formidable challenge of discerning whether the proposed changes could wield a transformative impact on the state’s taxation and governance frameworks that bring more positive outcomes than negative.

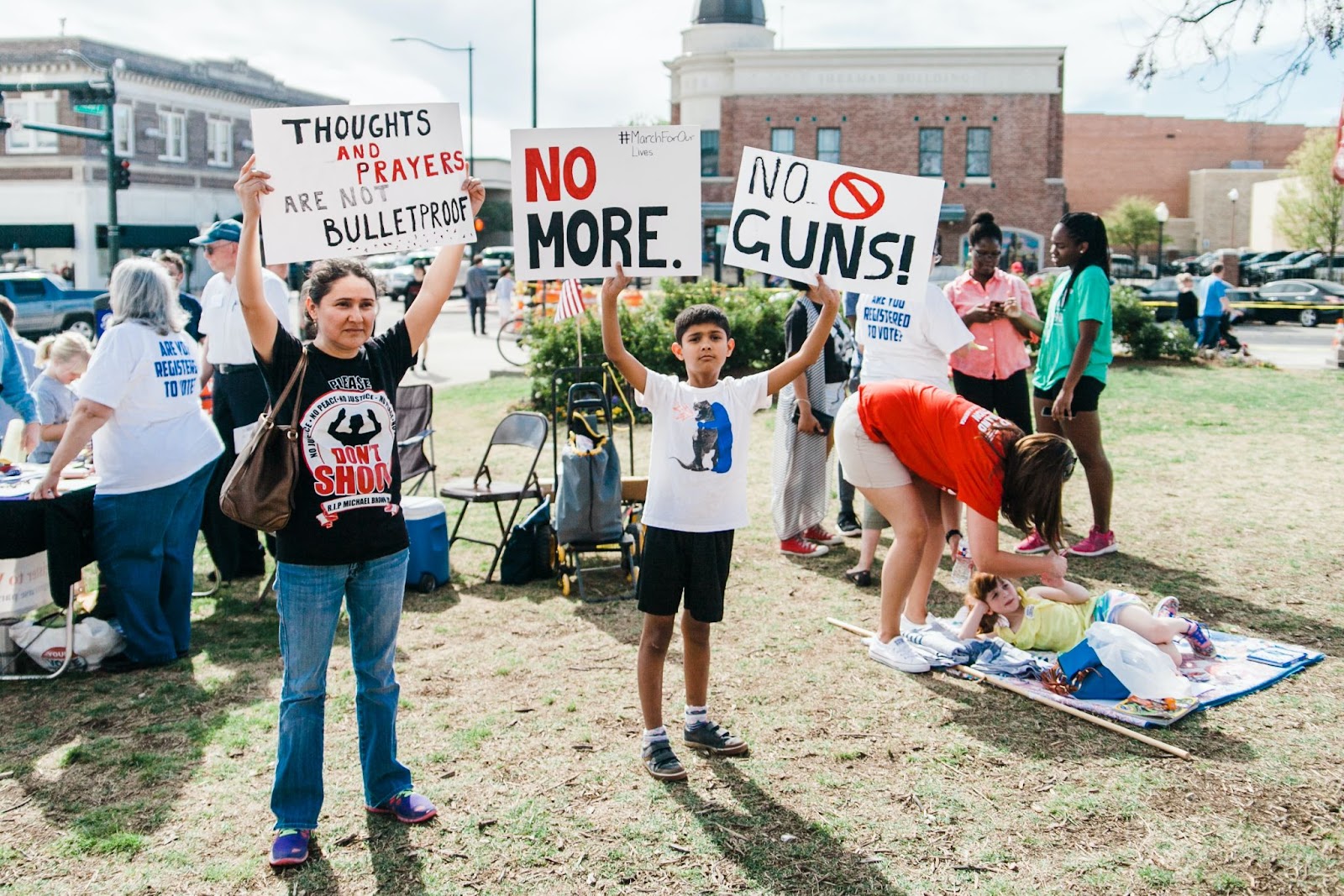

California Legislature presently holds the authority to enact tax increases with a two-thirds majority vote in both the Senate and Assembly. However, the contentious initiative, currently under scrutiny, endeavors to erect additional hurdles and procedural requisites. It advocates that any tax hikes greenlit by the Legislature must also secure voter approval to come into effect.

The initiative also seeks to elevate the voting threshold for community-driven tax increases from a simple majority to a significantly higher two-thirds majority. This would heighten the difficulty of passing such initiatives via popular vote.

Opponents of the measure, including Governor Newsom and select lawmakers, vehemently contest its implementation. They articulate deep-seated concerns regarding its potential to disrupt the delicate equilibrium of power delineated in the California Constitution. These political figures and lawmakers argue that the initiative could erode the Legislature’s jurisdiction over taxation and impede the executive branch’s efficacy in governing in the state’s and its citizens’ best interests.

Meanwhile, proponents of the initiative maintain that apprehensions surrounding its impact are largely unfounded. They assert that greenlighting the measure for the ballot would reinforce democratic principles, empowering voters with agency in shaping tax policy and acting as a crucial barricade against arbitrary tax hikes by elected officials.

The outcome of the momentous legal confrontation carries lasting implications for California’s fiscal terrain and the welfare of its inhabitants. Should the measure garner approval, it could ring in the dawn of a new era of tax policy, boosting voter supervision and more stringent procedural prerequisites for tax hikes at both state and local levels. Nevertheless, detractors caution that such seismic shifts could impede governments’ responsiveness to crises, potentially resulting in funding deficits for vital public services like firefighting and emergency response.

California’s Supreme Court continues to deliberate on the merits of the initiative, leaving the future of taxation in the state hanging in the balance. With the well-being of millions of residents on the line, the justices confront the responsibility of weighing the potential pros and cons, aware of the immense and enduring ramifications their decision can have on Californians going forward.