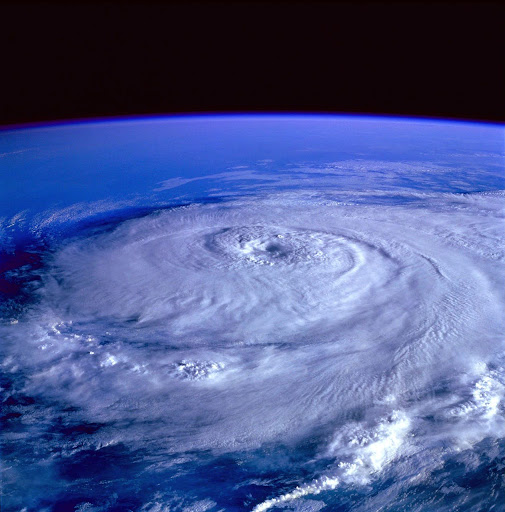

While mortgage lenders and rental properties often require you to have homeowners’ or renters’ insurance, no one buys or rents a home with the expectation of their private dwelling being broken into, catching fire, or flooding. However, unexpected events can leave you with overwhelming costs in damages that could drain your reserve, making the protection of home insurance crucial. Most home insurance policies cover losses and damages to your property when life’s unexpected happens, providing you with the best financial defense against unfortunate events like those already listed and more. However, thousands of California residents have lost their home insurance policies as home insurers leave the market, causing a home insurance crisis in the Golden State.

The property insurance market in California is experiencing a massive strain and facing challenges as four insurance providers withdraw from the wildfire-prone state. Two major insurance providers have recently stated their plans to reduce policies, citing the risk of earthquake-induced fires. State Farm and Safeco (owned by Liberty Mutual) have decided not to make decisions about policies for California residents.

But earthquake-induced fires aren’t something new. The deadliest earthquake in U.S. history happened in 1906 in San Francisco when a devastating magnitude 7.9 earthquake struck Golden Gate City. More than 80 percent of the city was destroyed, and over 3,000 lives were lost, marking the greatest loss of life from a natural disaster in the U.S. While this destructive earthquake caused significant damages, it only catalyzed the real catastrophe yet to come. Following this earthquake, a fire was induced that ravaged the city for days, accounting for about 80 percent of property loss and more than 28,000 buildings destroyed. While San Francisco has made impressive efforts to limit the impact of unexpected natural disasters, this historical event has returned to insurers’ minds.

State Farm and Safeco Withdraw From California Insurance Market

Last month, State Farm revealed that it would not renew about 30,000 homeowners, rental dwellings, and other property insurance policies, and the company would no longer offer commercial apartment policies. Believing it is necessary to take these steps now to ensure they can maintain sufficient claims-paying capacity, State Farm also wrote in a filing this year that “Personal Lines Homeowners and Dwelling Fire Insurance policies that present the most substantial wildfire or fire following earthquake hazards or are in areas of significant concentration are no longer eligible,” leaving many state residents in insurance crisis.

Adding further salt to the wound, Safeco announced their decision in a state filing to not renew nearly 1,000 homeowners policies in the San Francisco and Eat Bar areas, with a Liberty Mutual spokesperson stating last year that these areas have “significant earthquake risk and the resulting home fires they cause, and our high concentration of insurance exposure, we have taken the difficult but necessary step to further reduce our overall book of business through underwriting decision on new and renewal homeowner policies.”

Additional Insurers Withdraw Amid Climate Change Concerns

Two more insurers withdrew from the market shortly after State Farm and Safeco announced their withdrawals. Tokio Marine America Insurance Co. and Trans-Pacific Insurance Co. remarked that their decisions were also related to the increased risks of earthquake-induced fires, wildfires, and other natural disasters fueled by climate change.