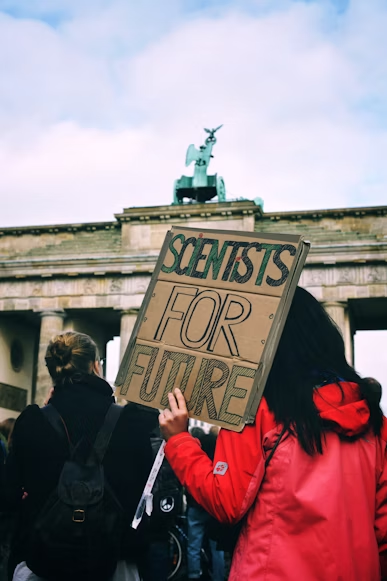

Image credit: Unsplash

While workers deserve livable wages, businesses must also generate enough revenue to meet their financial needs. This delicate balance is a significant struggle, particularly for many California fast-food restaurants. They feel the pressure since the state’s new $20 minimum wage for fast-food workers was enacted on April 1.

The Fast Food Franchisor Responsibility Act, which is responsible for raising the minimum wage for fast-food workers in California, applies to fast-food restaurants that meet specific criteria. Businesses falling under this category must operate as a “limited-service restaurant,” with minimal-to-no table service offered, and customers typically order and pay for their food or beverages before consuming them.

The legislation’s wage increase is representative of a subtle compromise between the fast-food industry and labor unions, who have been in negotiations for nearly two years, and reflects a significant shift in the labor rights landscape and economic policy that could serve as a model for other states considering similar measures.

However, while it may still be too early to fully comprehend the impact of the Fast Food Franchisor Responsibility Act since the wage increase has taken effect, many fast-food restaurants have raised their prices in response, which a recent study showed is resulting in additional negative impacts to these businesses.

A recent study by Placer.ai revealed that the new legislation is causing most quick-service chains to raise their menu prices significantly. These price hikes are not just hurting businesses; they are also drastically altering customer behavior. Earlier this year, fast-food restaurants in California were experiencing higher foot traffic than the national average. However, the menu price increases since the wage hike have abruptly shifted customers away from these establishments.

Placer.ai said that, from April through May, fast-food restaurants’ foot traffic dropped below the national average for seven out of eight weeks, further stating that quick-service burger chains were the hardest hit. The analytics firm provided an example from the global fast-food company McDonald’s, which has roughly seen the same year-over-year foot traffic in its Golden State locations as the rest of its restaurants nationwide during February-March.

However, after the minimum wage law went into effect, the company’s California locations, which account for about 9% of the company’s US restaurants, began to underperform by almost 250 basis points.

Another chain, Rubio’s Coastal Grill, closed 48 locations in California last month due to the high cost of continuing to operate in the state. The brand expressed in a statement that “making the decision to close a store is never an easy one… The closing was brought about by the rising cost of doing business in California. While painful, the store closures are a necessary step in our strategic long-term plan to position Rubio’s for success.” This closure is a stark reminder of the real-world impact of the wage increase.

Other California quick-service businesses feeling the heat of remaining running since the wage increase took effect are Burger King, Wendy’s, Jack in the Box, In-N-Out Burger, and Chipotle, which had raised its prices in the state by 6%-7% in hopes of combating the new law.