Image credit: Unsplash

Late into the second week of November, the expansion of New York-based Attentive in San Francisco has stirred the city’s real estate scene. The artificial intelligence (AI) company, valued at $7 billion, has set the trend for AI startups. Attentive has now expressed interest in the city’s commercial spaces.

Amidst this, a shocking announcement of the removal of the CEO from one of the city’s leading AI companies, OpenAI, has become a topic of discussion. The announcement has cast a shadow over the real estate sector, raising questions about the influence of AI on San Francisco’s real estate market.

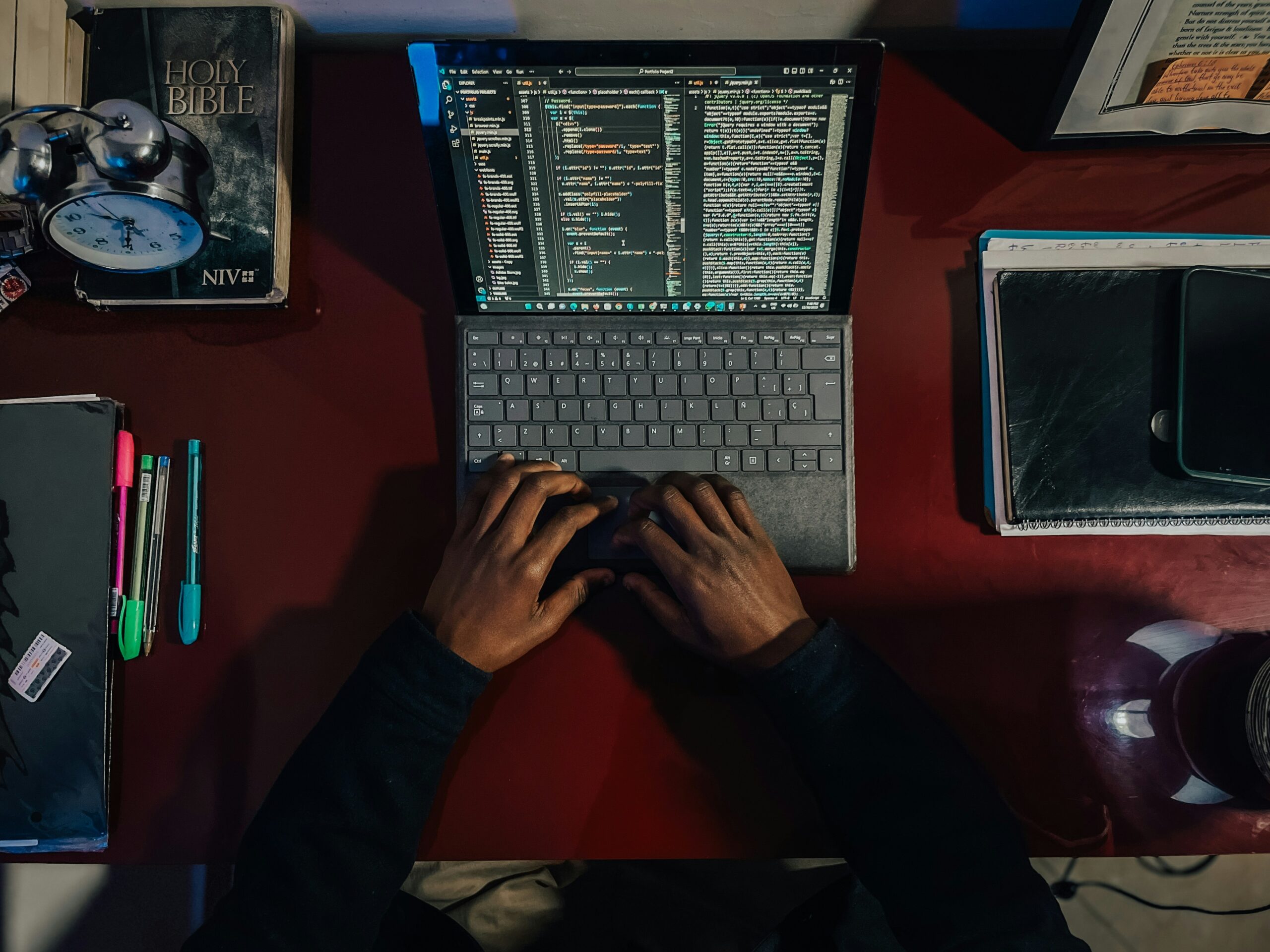

The recent turmoil at OpenAI has sparked concerns about the fate of the significant lease it inked last month– a 486,600-square-foot space at Uber’s Mission Bay headquarters. The former CEO, Sam Altman, was negotiating with the company to reclaim his position or potentially launch a new AI venture. Satya Nadella, CEO of Microsoft, swiftly offered him a position to lead an AI research team soon after OpenAI rejected his return.

Uncertainty Surrounding OpenAI’s Future

Following Altman’s unexplained dismissal, over 700 OpenAI workers and executives, out of approximately 770 employees, have signed an open letter threatening to quit unless the entire board steps down. This mass migration could profoundly affect OpenAI’s recently acquired Mission Bay office space. This may prompt considerations of lease termination or subleasing, which could potentially flood an already burdened market with empty space.

With multiple locations in the Mission District area, OpenAI has become a significant player in the city’s real estate sector. While other companies have inquired about taking over OpenAI’s spaces, the company has not disclosed its intentions so far. The uncertainty surrounding OpenAI’s prospects could impact the overall vacancy rate which is currently over 30%.

AI Startups Bolstering Demand

Despite the turmoil related to OpenAI, real estate insiders are optimistic about the AI sector’s influence on the market. This is evident in the recent commitments of AI startups such as Attentive, Anthropic, and Hive that have bolstered demand. Interestingly, JLL is expecting approximately 500,000 square feet of current demand from AI firms.

Nathaniel Touboul, a real estate partner at the law firm Allen Matkins, has acknowledged OpenAI’s situation as an anomaly because of its nonprofit status. According to him, it may lead to increased scrutiny from landlords and lenders. The rapid evolution of AI technology has introduced an additional layer of complexity to the ongoing process, as companies at the forefront of this industry may become obsolete in the coming months.

While some are predicting a slowdown on the recent developments of AI in San Francisco, Touboul remains confident that the sector will continue to flourish. He draws a comparison with the life sciences sector, highlighting the fact that challenges in tenant credit did not hinder its transformation into a red-hot market.

However, the impact of Altman’s potential shift to Microsoft remains uncertain. Some sources consider it a “net negative” for San Francisco’s real estate market, as the tech giant already possesses the infrastructure to replace Altman’s endeavors.

As the AI industry navigates this uncertain scenario, the potential emergence of new startups and a splintering of talent from OpenAI could generate additional demand for smaller office spaces in the city. The possibility of Altman’s future company within Microsoft has intensified the downstream effects on San Francisco’s real estate market.

While the future move of OpenAI remains a mystery, the overall sentiment is still cautiously optimistic about the continued growth of the AI sector in San Francisco. The real estate market, already majorly impacted by the technology businesses, remains resilient to adapt to the innovation of this evolving industry.