Image credit: Unsplash

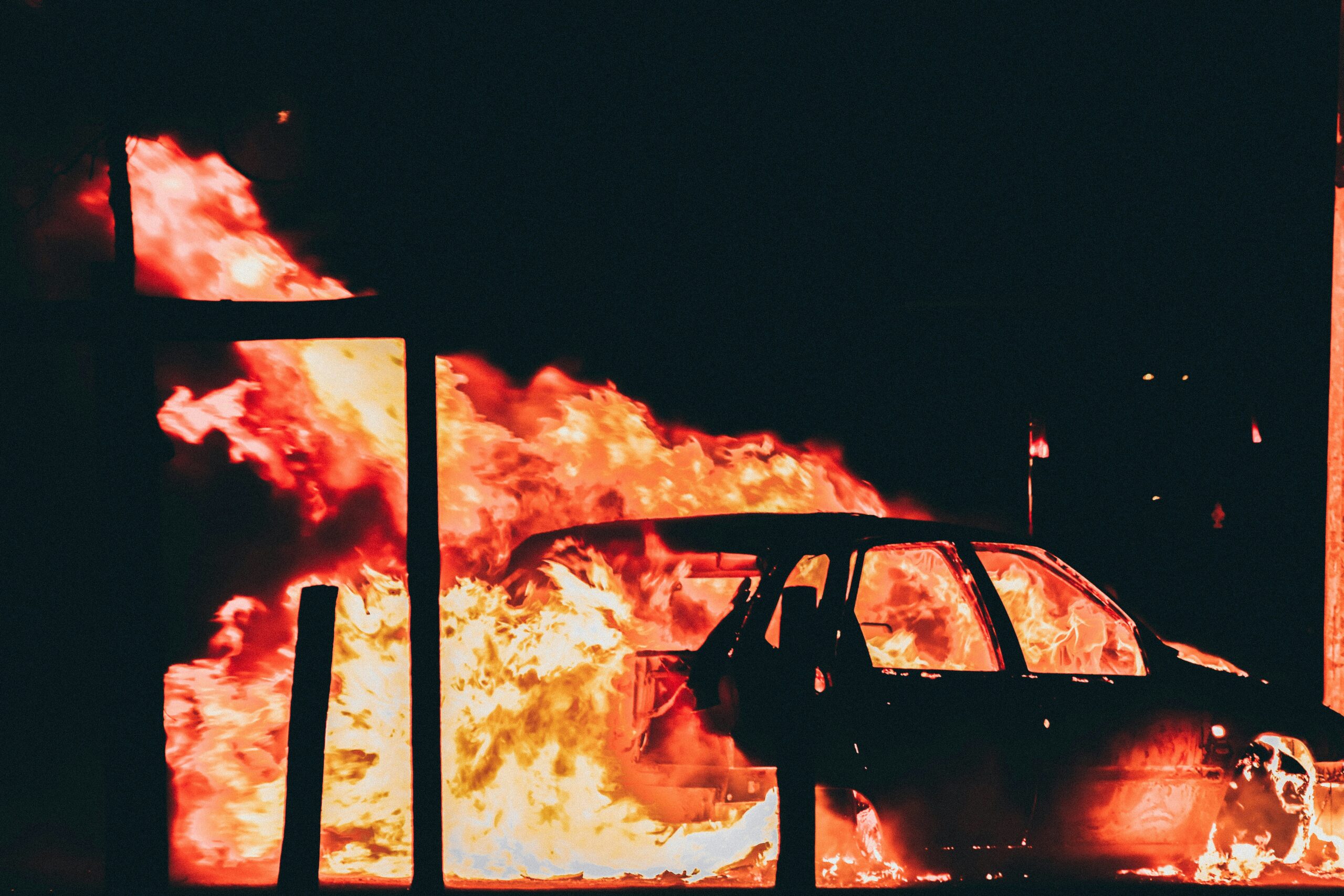

In the wake of the devastating CZU Lightning Complex fires in 2020, Californians face a stark reality – the prospect of an unstable home insurance market and skyrocketing premiums. Homeowners like Chris Finnie of Boulder Creek are emblematic of a growing crisis. Finnie was stripped of her insurance policy despite not losing her home to the fires. Subsequently, she was compelled to subscribe to the California FAIR plan, a state-mandated, minimal-coverage policy, which costs three times more than her previous insurance.

Insurance Commissioner Ricardo Lara is undertaking a challenging mission to stabilize this market. The plan involves making it easier for insurance companies to raise premiums. This initiative, however, is a double-edged sword, particularly for residents in fire-affected areas. In a state already burdened with high housing costs, the price of insuring homes is expected to surge significantly.

Historically, California’s insurance landscape has been favorable compared to other states prone to natural disasters. According to the Insurance Information Institute, the average Californian homeowner’s insurance premium in 2020 was $1,241, below the U.S. average of $1,311. However, the recent catastrophic wildfires in California have significantly altered this dynamic. These fires have accounted for the ten costliest U.S. wildfires regarding insured losses, necessitating a recalibration of insurance premiums.

As a result, major insurance providers like State Farm, Allstate, and Farmers Insurance have restricted or ceased issuing new policies in many areas of California. This has left homeowners with limited and costly options, primarily the FAIR Plan or no insurance, a dire choice for those needing mortgage-required insurance.

The FAIR Plan, established in 1968 to offer basic coverage in high-risk areas, has doubled its consumer base since 2018. Yet, it provides less coverage at a higher cost. For instance, Finnie’s annual premium under the FAIR Plan is nearly $2,800, a substantial increase from her previous coverage.

Jaimi Jansen, a businesswoman from Bonny Doon, echoes a similar plight. After her home survived the CZU blaze and her insurer dropped her policy, she now pays $14,000 for FAIR Plan coverage, ten times her previous rate. This steep increase has forced her to rent a room to manage expenses.

Insurers are pressing for reforms to address the risks heightened by climate change. They advocate for quicker approval of rate hikes, the use of computer risk modeling for rate calculation, and the inclusion of costs for secondary insurance in their rates. However, these demands have been met with strong resistance from consumer advocates, who argue that such changes would lead to higher premiums without ensuring new policy offerings.

Lara’s proposed overhaul, slated for completion by December 2024, seeks to balance insurer concerns and consumer protection. The plan involves significant regulatory changes, requiring insurers to provide 85% of policies in high-risk areas in exchange for regulatory concessions. However, this proposal has drawn criticism from both insurers and consumer advocates.

As California struggles with these challenges, one thing is clear – the path to stabilizing the home insurance market has numerous complexities and trade-offs. For homeowners like Finnie, the future holds a certain inevitability – insurance will become more expensive, adding another layer to the state’s already high cost of living.