Image credit: Unsplash

In an unsettling trend, homeowners across California are finding themselves unexpectedly dropped by their insurance providers due to aerial images that suggest increased risks on their properties.

This issue has come to light most recently with the case of Joan Van Kuren from Modesto, who received a non-renewal notice from her insurance company, CSAA, a part of AAA’s insurance network. The reason? A “substantial increase in hazards” was detected from aerial images, which Van Kuren believes were captured by a drone.

The notice shocked Van Kuren, who had just invested $200,000 in remodeling her home. “It almost feels like someone’s looking in your windows,” she told CBS Sacramento, expressing her discomfort with the idea of a drone surveilling her property. Despite her concerns, CSAA maintains that they did not use drones but instead relied on “proprietary aerial imagery” to make their decision.

This isn’t an isolated incident. Other homeowners in California, such as CJ Sveen in San Francisco and Cindy Picos in Northern California, have also received similar non-renewal notices from CSAA. These homeowners were informed that issues with their properties, including clutter and poor roof conditions, were the reasons behind the insurance company’s decision.

However, CSAA’s use of aerial imagery—whether through drones or other technologies—raises questions about privacy and the future of home insurance inspections.

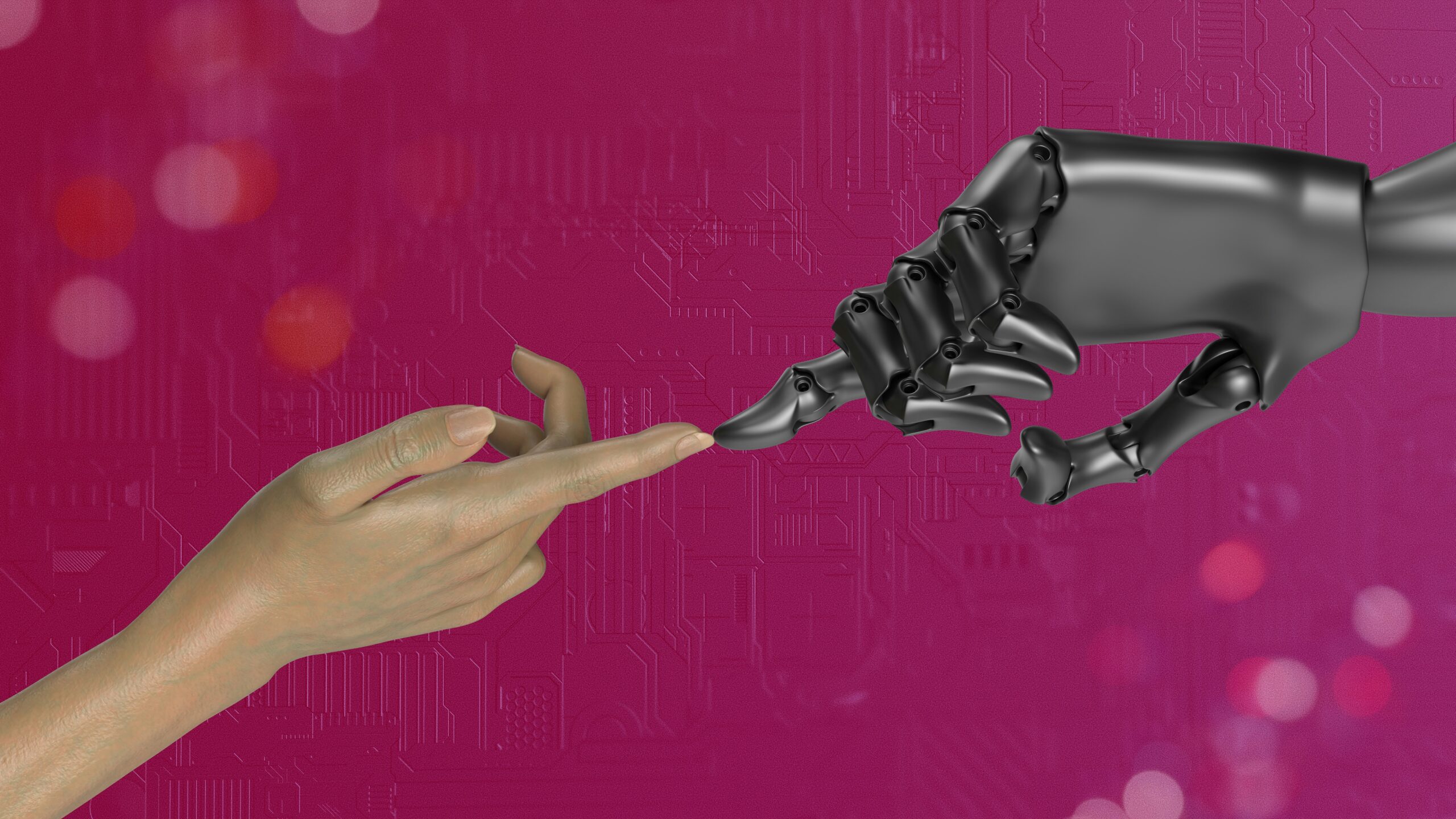

The use of drones in the insurance industry is not new. State Farm was the first to partner with the Federal Aviation Administration in 2015 to inspect properties using drones. Since then, drones have become an increasingly popular tool for insurance companies to assess damages after natural disasters and evaluate the properties’ overall condition.

According to information technology consultant Cognizant, drones capture detailed images that aid in claims processing and risk assessments, improving efficiency, accuracy, and employee safety.

In California, using drones for insurance inspections is legal as long as they don’t violate privacy laws, such as being used for voyeuristic purposes. However, insurance companies don’t necessarily need drones to obtain aerial images. Many, including CSAA, are part of the Geospatial Insurance Consortium (GIC), which provides high-resolution aerial imagery for its members. The GIC aims to build a comprehensive geospatial data library that insurers can use for everyday needs or in response to disaster events.

As the insurance industry continues to embrace technology, there is growing concern among homeowners and privacy advocates about the potential misuse of aerial data.

While these tools can enhance the accuracy of risk assessments, they also raise significant ethical questions about how insurers should be allowed to monitor private property without homeowners’ explicit consent.

For homeowners like Van Kuren, receiving a non-renewal notice based on aerial imagery can be confusing and frustrating. It’s important to understand that insurance non-renewal is different from cancellation. Non-renewal is a decision by the insurance company not to renew a policy at the end of its term, whereas cancellation typically occurs due to non-payment or fraud.

California law requires insurance companies to give at least 45 days’ notice before non-renewal and clearly explain the reasons. If homeowners believe the decision is unjustified, they can appeal. This can involve providing counter-evidence to the insurance company’s claims or filing a complaint with the state insurance regulator.

In any case, homeowners facing non-renewal should immediately begin shopping for new insurance coverage to avoid gaps, which could lead to higher costs due to penalties. Working closely with insurance agents can help homeowners find new policies that offer similar coverage and price points.

This growing reliance on aerial imagery and the resulting insurance decisions underscore the evolving landscape of home insurance in California and across the United States. As technology advances, homeowners must stay informed and proactive in managing their coverage and understanding the implications of these modern surveillance methods.