Image credit: Unsplash

A bill proposed in the California State Legislature recently attempted to fix a Medicare coverage issue that can affect seniors, especially those with pre-existing conditions. Becoming eligible for Medicare is a rite of passage for people reaching 65. There are two types of coverage to choose from: traditional Medicare and Medicare Advantage, which is sold by a private insurance company.

There are pros and cons to both traditional Medicare and Medicare Advantage. Traditional Medicare includes deductibles and copays but leaves gaps in coverage that patients supplement with Medigap private insurance plans. Since most doctors accept Medicare, patients under this type of coverage have a wide selection of doctors and hospitals to choose from. The monthly premiums of Medigap also help eliminate worries about unexpected expenses should a serious illness develop.

Medicare Advantage is issued by private insurance companies, so all the coverage is under one umbrella and eliminates the need for Medigap insurance. The policies also may offer additional benefits such as dental and vision insurance. Medicare Advantage plans are so popular that nearly half of all seniors initially choose this option. The downside of Medicare Advantage plans is that they confine patients to a network of doctors and hospitals, limiting choices in care.

Challenges of Switching Medicare Coverage

After a time, some patients might decide to change their Medicare coverage as their health needs develop. This is when trouble can occur.

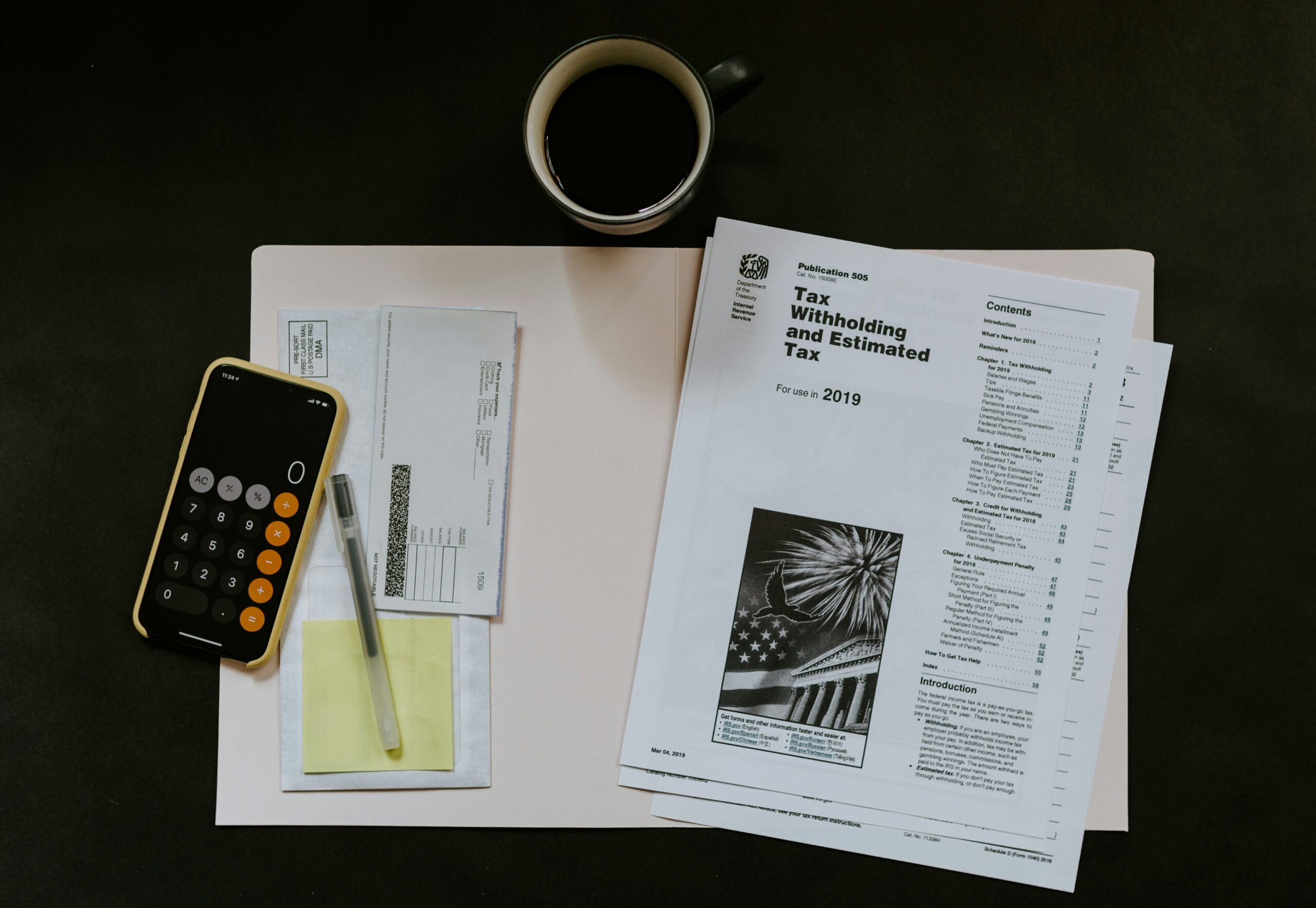

There is a six-month window for switching between insurances. After this window closes, the insurers of Medigap can raise the price of the policies or outright refuse coverage due to pre-existing conditions. Even if the seniors do purchase a policy, it might not include the conditions they need to be covered. Though the Affordable Care Act reformed the individual health insurance market to prevent these practices, the regulations don’t apply to Medigap after the six-month window timeframe, leaving seniors at the mercy of the insurers.

In California, alarm was raised about the Medigap issues when a San Diego hospital system, Scripps Health, stopped taking Medicare Advantage plans, forcing many California seniors to switch to traditional Medicare. When attempting to switch, the price of Medigap plans placed them out of the reach of many seniors.

Proposed Reform and Its Impact on Medigap Costs

California State Senator Catherine Blakespear responded with a Medigap reform bill that proposed a yearly 90-day open enrollment period. During the open enrollment, seniors would have the opportunity to switch without being denied or charged high premiums for pre-existing conditions. This is a concern for older people who are more likely to be diagnosed with leukemia and other blood cancers, a major reason why the Leukemia and Lymphoma Society supported the bill.

The insurance lobby responded by declaring that if more people with pre-existing conditions were to switch to Medigap plans, premiums would have to be raised for all policyholders. A state budget analysis of the bill confirmed this assertion by projecting that Medigap premiums would rise to about 80 dollars a month, a 33% increase. Such a jump in cost would impact lower-income seniors, placing the Medigap plans out of their reach.

The appropriations committee failed to advance the bill to a full vote in the Senate much to the disappointment of its supporters.