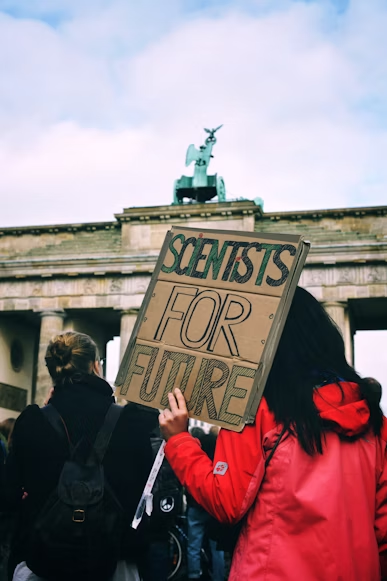

Image credit: Unsplash

Home prices have continued to rise across the United States, and California has proven to be no exception. KTLA 5 has reported that the median price of a single-family home in California climbed to $904,210 in April of 2024, which put it at 11% above April 2023. Despite the growing costs, home sales in California have also increased monthly by a low single digit.

Despite economic concerns and a higher cost of living, California has recently experienced population growth. FOX11 Los Angeles reports that for 2023, California had its first positive population growth since 2020, when housing prices first spiked.

The article also states that nine out of ten counties in California with populations over one million saw population increases, comprising 72% of the state’s total population. This includes 31 counties, most in the Bay Area, Central Valley, and the Inland Empire.

With California’s ongoing affordability crisis and housing expenses, purchasing a house in an urban area is daunting. However, the recent population boom has proven the potential for real estate investment in the Golden State. Those looking for a stable investment or a new home might look to California’s growing suburbs instead.

A similar report by FOX11 Los Angeles includes a list of California’s fastest-growing suburbs with house prices under $500,000. This pits home prices in the suburbs against popular urban areas such as Los Angeles, which has a medium starter home price of $615,000, or San Francisco, which has a medium starter home price of $970,000.

Aside from a lower floor for buyers, California suburbs offer other incentives to make them suitable investments. They maintain proximity to major cities without the same levels of traffic. Crime rates in suburban areas also tend to be lower. According to USA Facts, the DOJ has reported that residents of suburban areas report lower rates of victimization by crime than those in urban areas.

Another factor that might spark more significant investment in these California neighborhoods is an impending federal cut to interest rates. Reuters reports that the Federal Reserve will lower interest rates by 25 basis points at the US central bank’s three remaining policy meetings in 2024. Reduced rates will lower the cost of borrowing, providing relief for housing prices that continue to climb. This could be yet another boon to California’s growing housing market.

Although the California suburbs promise long-term returns for investors, the growth has yet to be distributed equally across the state. A report by Yahoo Finance investigates which suburban locations have the highest economic growth projections. Some factors included in this report are cost of living, property appreciation, and crime rates.

The suburbs listed in Yahoo Finance’s report were Folsom in the Sacramento Area, Irvine in Orange County, Temecula in Riverside County, and Poway in San Diego County. The article advised that Poway is an excellent investment due to its affordability and low crime rate. Poway, which the article advised as a rural area until 1980, was considered a rural area.

Rising home values have prompted more farmers and landowners to sell their properties for development, which could signal a more significant trend in how the housing market transforms Californian neighborhoods.

While these Californian suburbs are enjoying growth, not every corner of the Golden State has benefited from the population boosts. A report by Go Banking Rates has named two separate Californian cities among the ten worst American cities for property investment. The article claims that Ontario, California, needs help attracting major employers and more infrastructure.

Similarly, the article cites Stockton, California, as a poor area for investment due to its high foreclosure rate amidst economic difficulties.

As California’s housing market returns, potential home buyers and investors again look to the state, famed for its large economy and popular urban areas. Impending federal rate cuts could further fuel rises in home sales. With these factors at work, many looking for affordable investments are turning to the growing Californian suburbs, hoping to see long-term returns.